Reading time: 6 minutes

The most common and best-known form of leasing is automobile leasing, and many SMEs use it to acquire one or more cars. But machines? Although leasing is an ‘established procurement instrument,’ it remains subordinate to purchasing, according to a study by the KfW SME Panel on the use of leasing by small to medium-sized companies. The study found that 18 percent of leasing users in the manufacturing sector had taken out contracts to finance the acquisition of production machinery when the data was collected in 2021 and 2022.

According to a more recent study commissioned by the Federal Association of German Leasing Companies (BDL) and published in 2025, 60 percent of SMEs consider leasing when it comes to investments. Nevertheless, investments in mobility, i.e., electric cars, electric trucks or even electric bikes, also dominate in this study. Machinery, on the other hand, is financed mainly via cash flow or loans. However, this could change soon. When asked how they intend to finance lower-emission machinery or robot-controlled manufacturing systems in the future, most SMEs surveyed said they would switch to leasing.

Deutsche Leasing, which is part of the Sparkassen Group and Germany's leading manufacturer-independent leasing company, also sees machinery leasing on the rise. “It has become an established feature of the SME sector and is continuing to grow in significance,” says Stefan Tromm, Head of Corporate and Business Customer Business. In the 2023/24 financial year, 47 percent of Deutsche Leasing’s new business comprised investments in machinery and operational facilities.

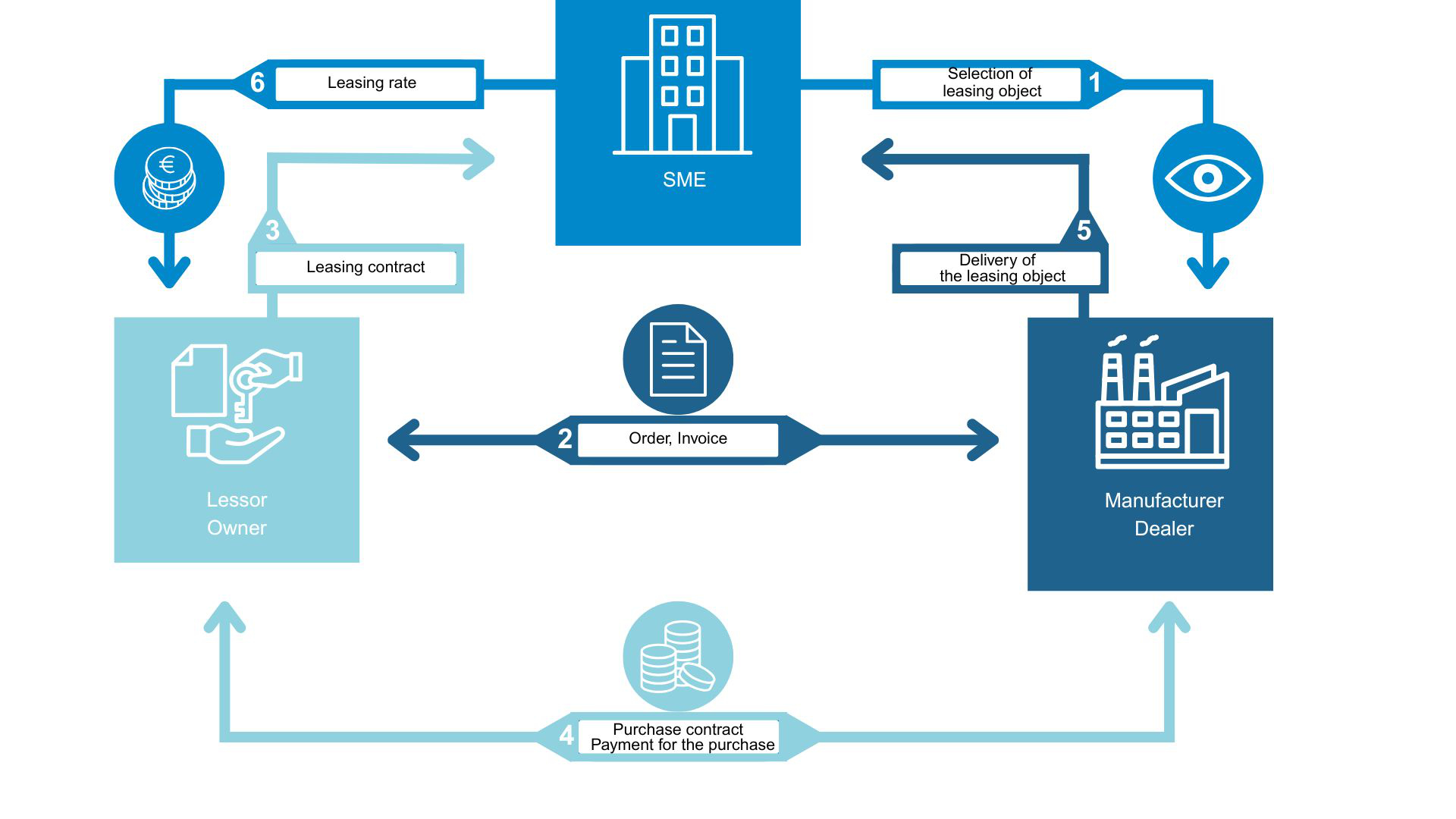

Example of a leasing transaction involving the lessor, the lessee (SME) and a dealer or manufacturer.

Association: a minor role in the butchers' trade

But what about the meat and protein sector? Even artificial intelligence is unable to find valid figures on the use of leasing there. However, Hans Christian Blumenau, business expert at the German Butchers' Association, reports that, in his experience as a consultant, "Although leasing plays a role in the butchers' trade, it tends to be a minor one and depends on the business concerned. Leasing agreements are common for cash-register weighing systems and vehicles but less so for machinery and equipment. My subjective impression is that the majority of these are purchased new and financed."

Access to the latest technology without committing capital

This is surprising, given that leasing offers several tangible benefits. Deutsche Leasing, for example, also offers leasing models to new companies, provided they have been in business for at least three years. “Unlike credit financing or buying second-hand, leasing ties up less capital and provides access to the latest technology,” says Stefan Tromm. Cost predictability and the option of returning the leased asset at the end of the contract are other important reasons why many companies opt for leasing models.

Apart from the financial benefits, megatrends such as digitalisation and sustainability are key drivers for lease-financed investments. "Leasing permits the rapid and cost-efficient integration of new data-based systems and business models. Sustainability plays an important role in this respect, as modernised technology is often more energy-efficient and environmentally friendly," says Stefan Tromm. According to the BDL study, two-thirds of the SMEs surveyed regard leasing, in combination with government subsidies, as a decisive lever for investments in digital transformation and sustainable technologies.

Manufacturers are seeing rising demand from start-ups in the alternative proteins sector

New machines can be leased not only from leasing companies but also from the manufacturers themselves, either directly or through leasing partners. Leasing is an attractive option for start-ups with limited financial resources, as is often the case in the protein industry, because it preserves equity capital and gets production up and running. “We are seeing dynamic growth here,” says Julian Hecker, Vice President and Divisional Representative Food & Healthcare at GEA. “Many start-ups in the protein industry, especially in the new-food sector, are using leasing as a strategic financial tool. Demand for leasing in the meat industry, however, is flat to slowly rising, with many companies still preferring to own their equipment. In this sector, leasing is sometimes perceived as being risky or too bureaucratic.”

Generally speaking, new companies in the protein sector are more innovative and willing to experiment than those in the traditional butchers' trade. However, the challenge they face is to remain competitive by scaling up quickly and integrating new technologies despite having limited capital. “Leasing fits in well with this logic because it combines operational efficiency with low capital requirements at the same time as reducing the burden on the balance sheet," says Hecker. GEA, an international system provider for the food, beverage and pharmaceutical industries, gives start-ups the opportunity to test machines and equipment in the company's own test centres before signing a purchase or leasing agreement: “In practice, this is very often the case. Customers test their recipes and scaling in the test centre before making a purchasing decision."

With its broad portfolio for food processing, Handtmann also has its sights set on the protein industry. This is because vegan products made from alternative proteins such as burger patties, nuggets, sausages, bacon and steaks – as well as filled snack products and other innovations – can be produced just as easily as corresponding meat products. “Start-ups need process technology that is tailored to small quantities,” says Winfried Hartwig, industry manager for alternative proteins at Handtmann. “Practical and, above all, flexible solutions have a direct, positive impact on production. When increasing quantities need to be handled, daily production can often be scaled flexibly simply by adding an additional attachment. At Handtmann, we try to support start-ups at a very early stage with attractive financing models.”

Maschinenfabrik Seydelmann, based in Stuttgart, also offers leasing options for new machines, such as cutters and mincers. Whether for small butchers or chains with 50 employees, “Leasing is becoming increasingly popular," says Martin Krippl-Stojic, Head of Marketing and Communications. In his experience, "There has been a gradual shift in thinking among artisan businesses towards modern and more flexible ways of staying at the cutting edge of technology at the same time as reducing business costs and risks. Many are reluctant to make a large investment without knowing what the future holds."

Although Holac, a manufacturer of cutting technology, offers leasing services, it has so far only done so in the traditional meat and cheese sector. In the alternative protein market, which Holac entered eight years ago, the company has only sold equipment directly, not on a leasing basis. Nevertheless, Elvedin Ramani, Industry Manager Alternative Proteins, believes that leasing could also play a greater role in this market because, "The financing environment has become more difficult and start-ups in particular cannot afford to take too many risks."

Refurbished machines are exported

Purchasing refurbished machines represents an alternative to new ones. Seydelmann calls its fully overhauled machines ‘factory reconditioned’. "This involves not only replacing worn parts but also completely dismantling and rebuilding the machine, as well as upgrading it to the latest standard, including a new drive system and the use of state-of-the-art controls. The machine then corresponds to a new one in terms of both technology and quality," says Krippl-Stojic. Most of these machines are sold abroad and are distributed through Seydelmann representatives in 150 countries.

Hauenstein Fleischereimaschinen GmbH also exports refurbished machines to all continents. These machines, which include models from other manufacturers, are sold through a network of dealers and include cutters, mincers, sausage filling machines, injectors and tumblers. "We dismantle the machine down to the last nut and bolt, and then reassemble it," says CEO Marco Hauenstein. However, subsidies for new machines, combined with high discounts and trade-ins offered by the original manufacturers, represent tough competition for refurbished machines.

Leasing, a brief explanation

The basic idea of leasing is simple. Instead of buying an investment or consumer good yourself or financing it with borrowed capital, you hire it. The lessor, usually a leasing company affiliated with a manufacturer or bank, procures and finances the leased asset and allows the lessee to use it in return for payment of a contractually agreed fee. In addition to traditional finance leasing with a purchase option, there are also more modern models offering even greater flexibility. ‘Pay-per-use’, for example, links the leasing instalments to actual usage and makes it easier to compensate for fluctuations in production. Another variant, especially for companies with liquidity problems, is ‘sale and leaseback.’ In this case, the lessee sells a machine that has already been used to the leasing company in return for immediate liquidity, while continuing to use the machine in exchange for leasing payments. Maintenance and service packages for machines and equipment can be integrated into leasing contracts as required, as can insurance.

Sources

Bundesverband Deutscher Leasing-Unternehmen

https://bdl.leasingverband.de/leasing

Deutscher Fleischerverband

https://www.fleischerhandwerk.de/

Handtmann

https://www.de.processing.handtmann.com/

Hauenstein Fleischereimaschinen

https://www.hauenstein-gmbh.de/

Holac

https://holac.de/

KfW Mittelstandpanel

https://www.kfw.de/%C3%9Cber-die-KfW/Newsroom/Aktuelles/News-Details_779904.html

Seydelmann

https://www.seydelmann.com/