Reading time: 6 minutes

Pet ownership is a global trend, with the pet population reaching an all-time high worldwide. This impressively demonstrates how close the bond between humans and animals is. The number of dogs, cats, small rodents and birds in households rose sharply, especially during the coronavirus pandemic. The reason: these animal companions provided their owners with emotional and mental support during lockdown.

Pet food – a real growth market

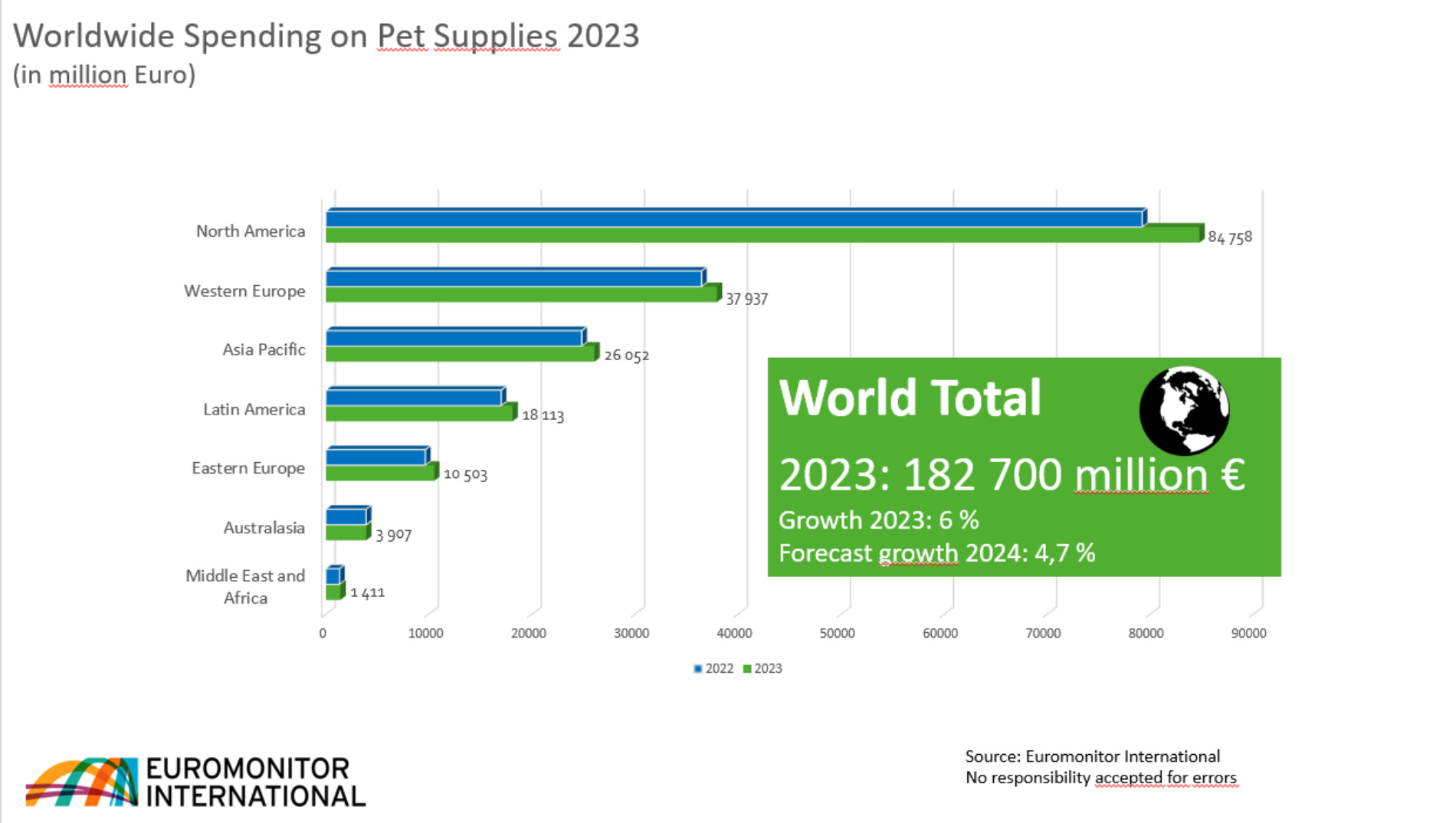

People generally enjoy living with their pets and attach great importance to their well-being. Despite rising living costs and a subdued economic outlook, pets, which 70 per cent of participants in a Euromonitor study describe as family members, are the last thing people cut back on. Last year, manufacturers of pet supplies (food and accessories) generated sales of around 183 billion Euro worldwide.

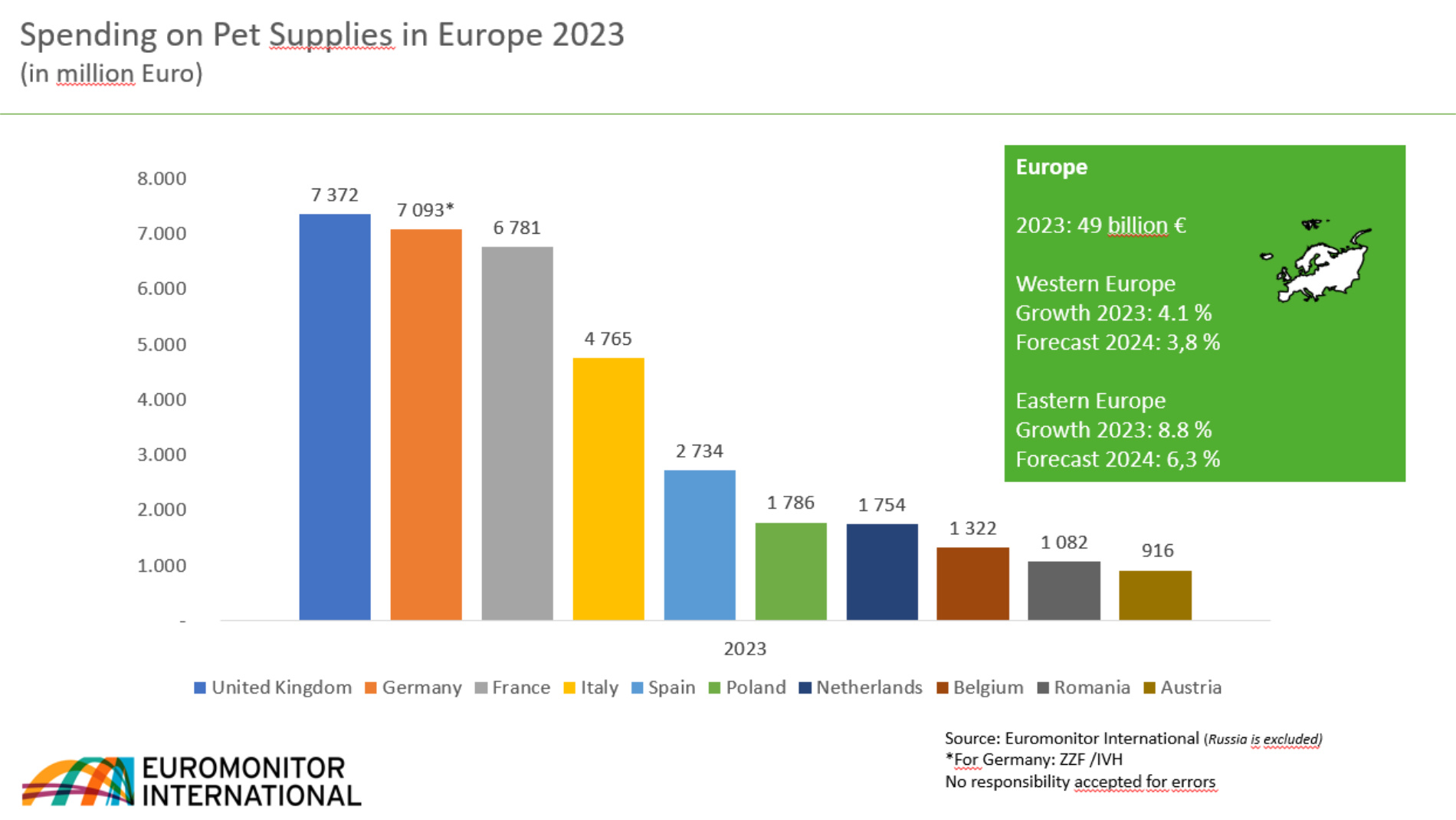

With a predicted market volume of around 85 billion Euro, the United States generates the highest turnover, followed by China, the United Kingdom and Brazil. In Germany, the pet industry exceeded the 7 billion Euro turnover threshold for the first time, placing it second in Europe behind the United Kingdom. In Europe, turnover for pet food alone was 40 billion Euro in 2024, with Germans spending 4.3 billion Euro in the same period. Analysts predict further strong market growth across the globe until 2030.

Customised and Premium Pet Food Options

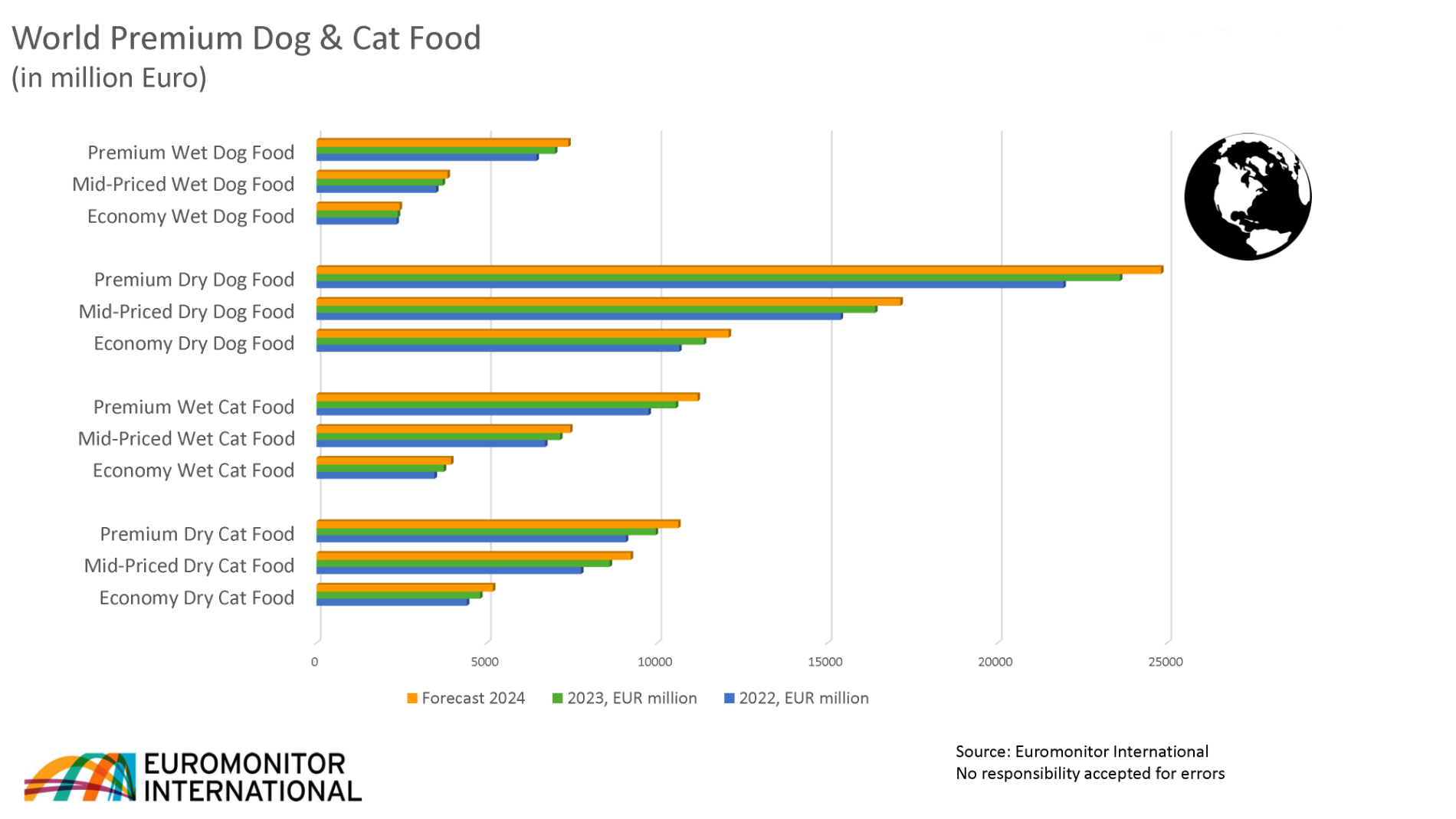

Gone are the days when pets were served unattractive brown mush from tins or dry brown chunks. Today, “gourmet menus” have largely replaced these, often resembling ready meals for humans or simply requiring hot water in an instant cup. Pet popcorn, pretzels or hamster cookies mirror their owners’ food preferences. Premium food – expected to be of higher quality and to promote vitality and longevity – continues to be in high demand.

In addition to this premiumisation, vegetarianism and veganism as trend topics in the human sector are influencing product developments in pet food, as are health-promoting and health-maintaining supplements. The large market for pet food and snacks is diversifying rapidly: manufacturers are supplying personalised, tailor-made and environmentally friendly options – including organic products on request. They tailor their recipes to the weight, breed, age, size, activity level and pre-existing conditions of the individual animal, often developed in collaboration with veterinary experts.

Alternative Proteins as Pet Food Sources

German pet food producers faced a significant challenge in 2023 due to declining meat production, which dropped to just 6.9 million tonnes. Although production rose by 97,200 tonnes in 2024 after seven consecutive years of decline, many producers have turned to insect protein, now making up about 7 per cent of the pet food market. With a growing emphasis on sustainability among pet owners, experts anticipate double-digit annual growth in this area.

Insect protein production is considerably more environmentally friendly than that of pork or poultry – with lower greenhouse gas emissions, reduced water and feed requirements, minimal soil pollution, and small space demands. Producing 1kg of insect protein releases only 14kg of greenhouse gases, compared to up to 175kg for the same amount of beef protein. Insect larvae are dried, milled into flour, and serve as a hypoallergenic protein source, ideal for dog and cat food. Insects such as the Black Soldier Fly are used, with French biotech firm Agronutris developing digestible proteins and lipids. Other producers are experimenting with mealworms and silkworms. However, insect farming in Germany is still in its infancy, with only two breeding operations to date.

Plant-based proteins are also valued as healthier and more sustainable. Products with reduced animal protein content are increasingly used, even though dogs and cats are natural carnivores. Rice protein, for example, is well-suited to pets with allergies or sensitive digestive systems, such as puppies and older animals.

A successful example of meat-free protein integration was presented at Interzoo 2024 in Nuremberg, the world's leading trade fair for pet supplies. Dr. Clauder's, a German manufacturer, presented a vegan, air-dried dog snack made from cultivated protein, which is intended to contribute to sustainability and offer nutritional benefits. The processed protein is produced without genetic engineering through natural fermentation.

Sustainability Trends in Pet Food

Eco-conscious pet owners are avoiding overpackaged products and prefer biodegradable, resource-efficient and ethically sound solutions. Refillable options and bulk-buying initiatives are being explored. Flexible plastic sausage casings reduce waste, though traditional clips pose a safety risk. German firm Handtmann now offers sausages tied with string instead of clips, improving pet safety and achieving a handcrafted premium appearance.

Sustainable packaging must also ensure long shelf life and affordability. Machinery manufacturer Multivac, in cooperation with foil manufacturer Südpack, is developing flexible packaging for wet food with 50 per cent less material, easy opening, no sharp edges, and a shelf life of up to 12 months.

Sustainable pet food also includes regional and natural ingredients and minimal processing. Artificial colours, flavours and preservatives are being phased out, as is grain, which can cause digestive, skin, and allergy issues in dogs. Its high energy density can lead to obesity in cats, resulting in dental, kidney and digestive problems. In Germany, 15 per cent of cats and 19 per cent of dogs are overweight. Special diet products help prevent or alleviate joint conditions, boost immunity, and support digestion.

In North America, nearly a quarter of pet owners worry about obesity. Pet food formulations there focus on weight management with high-protein, high-fibre, and high-fat ingredients like oats, quinoa and chia, which increase satiety and help prevent overeating.

Dry or Wet Food?

Most pet owners prefer industrially manufactured dry and wet food due to convenience and long shelf life. The industry offers an overwhelming range of new products: dry food is enhanced with beetroot, carrots, peas or spinach, while meat varieties include chicken, lamb, pork, offal, salmon, herring or seafood. Various textures – crispy, chewy, chunky, or soft – are also available.

In wet food, health benefits are a key focus. Ingredients such as probiotics, psyllium husks, or flaxseed support digestion, and calcium-rich formulations promote bone health.

Pet owners who prefer home-cooked meals for their animals quickly face challenges: only diets precisely tailored to the pet’s needs are balanced and complete. Start-ups are already stepping in, offering breed-specific cookbooks or recipe boxes with fresh ingredients, similar to “HelloFresh” or “PrepMyMeal”. Raw food diets (BARF = Biologically Appropriate Raw Food) enriched with oils, dried fruits, vegetables, supplements, and vitamins can be customised in-store at “meat corners”.

Pet Health and Wellness

New pet food product launches are driven by innovations targeting dental care – reducing plaque, freshening breath and improving oral hygiene. Pet owners also value products that promote vitality. For instance, Dogcs offers a vet-developed anti-ageing liver sausage-flavoured supplement to sprinkle over food. At last year’s Interzoo, the trend toward pet lifestyle products was evident. Supplements, protein and collagen powders from green-lipped mussels or spirulina algae are now in demand in the pet sector as well.

“People project their own lifestyle and dietary concepts onto their pets – whether for health reasons or due to ethical convictions. Dog owners who care about their own diet or follow new trends tend to be equally picky when it comes to feeding their four-legged friends.”